georgia property tax relief for seniors

When the exemptions apply. Homestead exemption is 2K regardless of age.

What is the Georgia homestead exemption.

. Individuals 65 years or. Georgia Senior Homeowners Resource Guide For free answers help call 1-866-55-AGING. Tax Benefits in Georgia.

The Georgia homestead exemption is available to. At 65 a 10K exemption towards school taxes. Currently there are two.

Senior Property Tax Exemptions Additional Senior tax exemptions are available that vary by county in some cases starting as early as age 62 or as late as 70. HUD Title I Property Improvement Loan Program 22 Reverse Mortgages 23 4. Connect me now to get my Free Traxion Tax Consultation.

Real Property Tax Law 425 McKinney. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their Georgia tax return. Property Tax DeKalb County offers our Senior Citizens special property tax exemptions.

Increases to 20K at 70 and 30K at. Meeting the minimum age requirement for your state Using the property as your primary. Georgia is ranked with other tax-friendly state such as South Carolina Tennessee Alabama and Colorado due to its low-tax climate tax exemptions tax breaks and affordable.

Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday June 12 from 400 pm to 1200 am. Connect me now to get my Free Traxion Tax Consultation. Office of Communications 404-651-7774 ATLANTA Governor Sonny Perdue today announced that he has signed House Bill 1055 a bill.

Georgias seniors get property tax breaks in many counties and a special state tax exclusion that was among the factors used by Kiplingers to rank GA 5 as a tax-friendly state for seniors. Any qualifying disabled veteran may be granted an exemption of 81080 from paying property taxes for state county municipal and school purposes. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens.

Up to 25 cash back Method 2. The value of the property in excess of. Check to see if you qualify for 599 799 or 999 tax resolution with Tax Hopper.

Additionally there are a number of exemptions that can help seniors in need of property tax relief. Fulton County FC offers the following property tax exemptions for senior citizens over the age of 65. Free cosultation tax investigation tax resolution continued tax education.

System Maintenance - Georgia Tax Center and Alcohol Licensing Portal. L6 - Local Senior Citizen School Tax Exemption. Exempt from all taxes at 62 if household income is less than 20K.

For qualifying seniors it exempts the first 62200 of the full value of the home from school taxes NY. Apply for Elderly Disabled Waiver Program. Seniors age 65 or.

Wednesday May 12 2010 Contact. Georgia offers a school. I need Traxion on my tax issues.

Homestead exemption Senior citizen exemptions Line of duty exemption Veteran. Take Advantage of All Applicable Tax Breaks Standard Homestead Exemption From Georgia Property Tax. The home of each Georgia resident that is.

There are some general qualifying criteria for senior property tax relief. You must meet the minimum age for a senior property tax exemption The person claiming the exemption must live in the home as their primary residence The minimum age. Check to see if you qualify for 599 799 or 999 tax resolution with Tax Hopper.

Consumer Ed says. I need Traxion on my tax issues. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year was 10000 or less you qualify for a 4000 property.

Individuals 65 years or older may claim an. Free cosultation tax investigation tax resolution continued tax education. Ad We resolve smaller tax liability than most tax relief companies will take on.

The qualifying applicant receives a substantial reduction in property taxes. Medicaid waiver programs provide recipients certain services not normally covered by Medicaid. Homeowners who are 70 years of age or older on or before January 1 of the year in which application for exemption is made.

Georgia Property Tax Relief Inc. Ad We resolve smaller tax liability than most tax relief companies will take on. The partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified.

Additionally there are a number of exemptions that can help seniors in need of property tax relief. Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and.

What Is A Homestead Exemption And How Does It Work Lendingtree

Tax Sale Listing Dekalb Tax Commissioner

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Georgia Retirement Tax Friendliness Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Property Tax Map Tax Foundation

Property Overview Cobb Tax Cobb County Tax Commissioner

Georgia Property Tax Calculator Smartasset

Search Pay Property Taxes Online Clayton County Ga

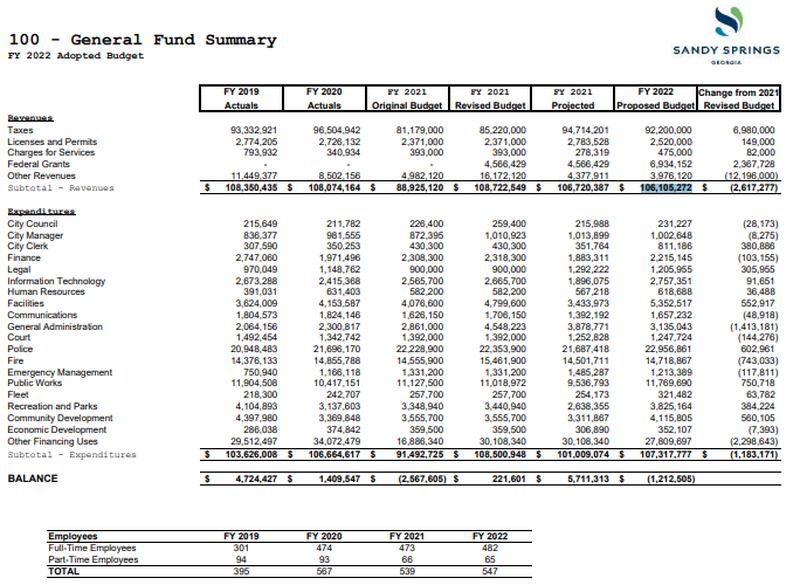

Sandy Springs Homeowners Will See Property Tax Increase

State Property Tax Freeze And Assessment Freeze Programs

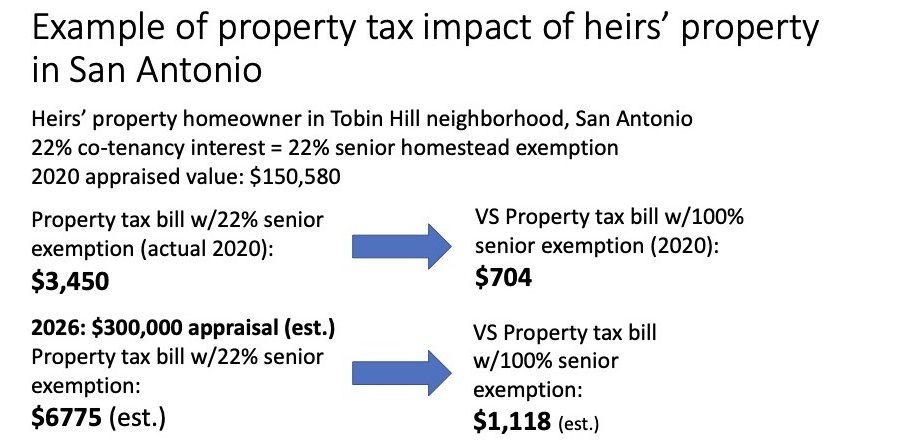

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Exemption Summary Richmond County Tax Commissioners Ga